CaptivesAtTheCore: The Foundation of a Risk Financing Strategy

25.05.2017Company: Amcham

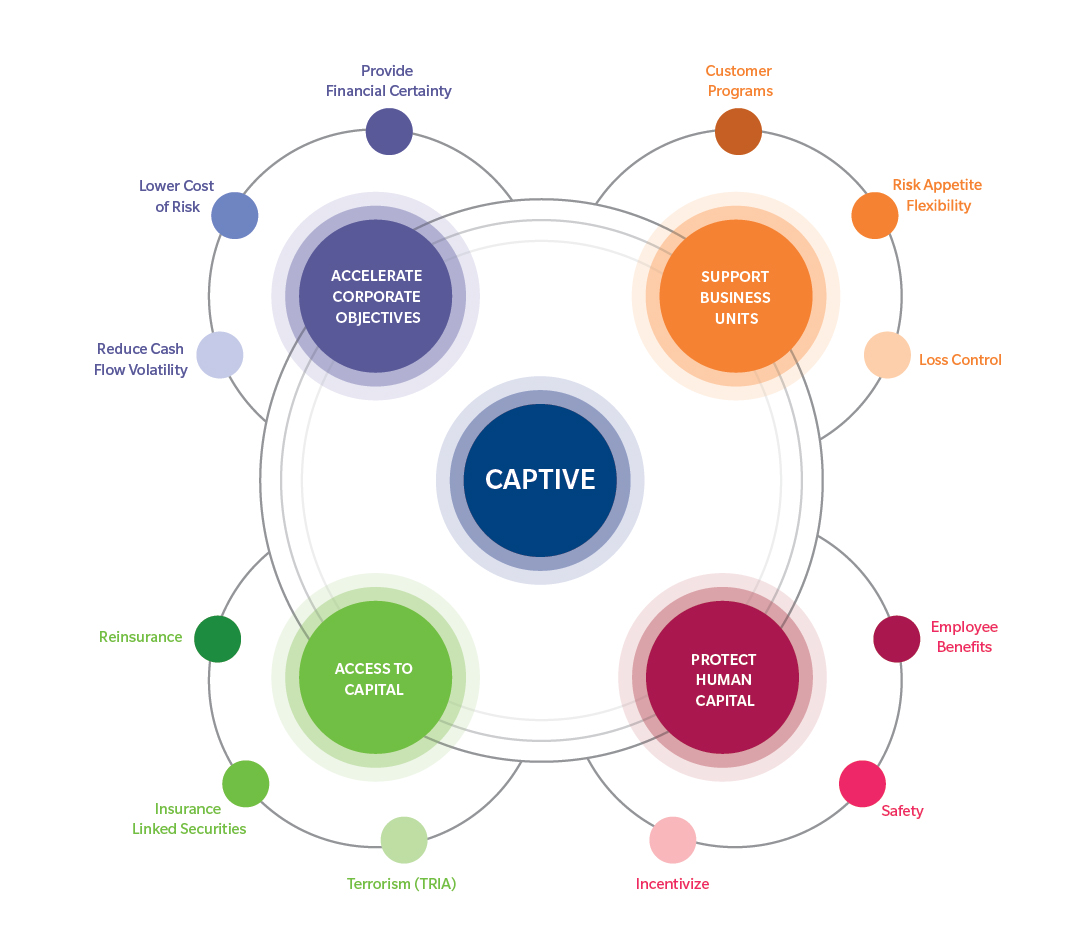

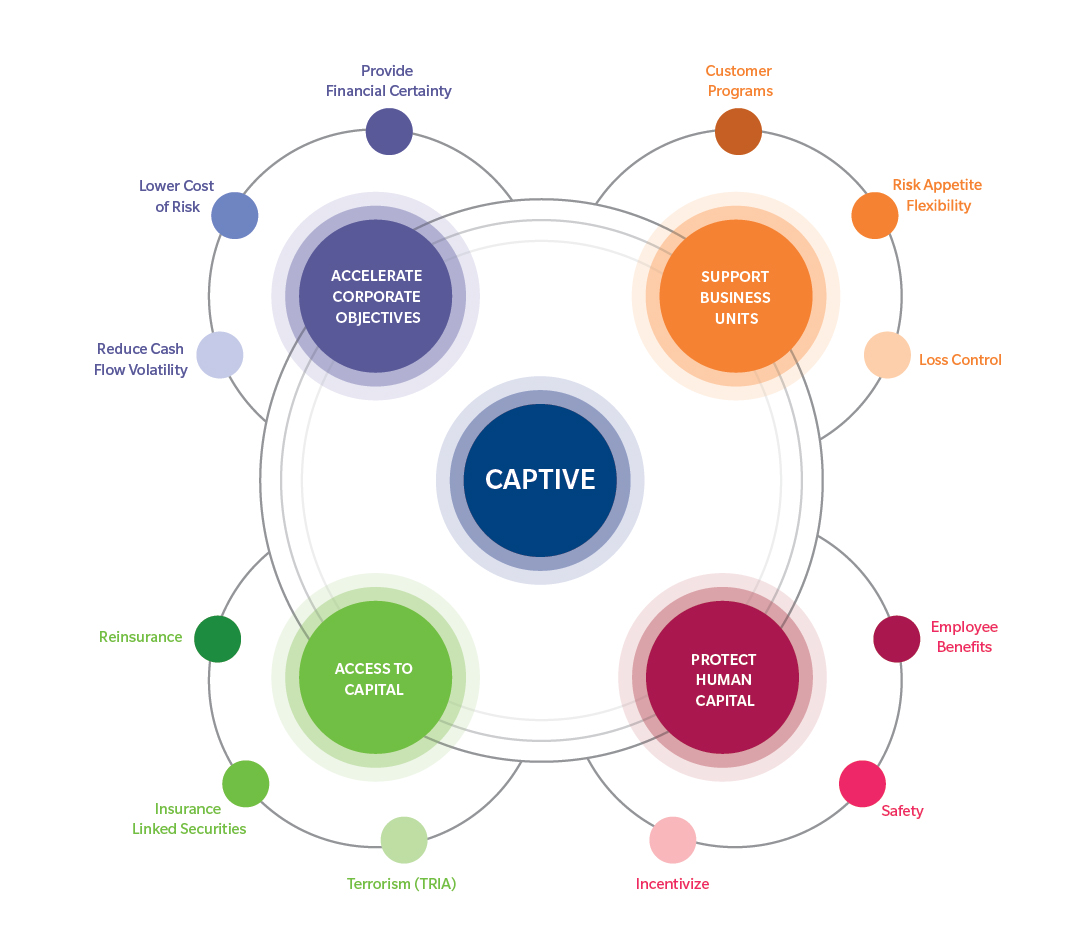

This marks the 10th year that we have published an in-depth captive report. Today, global economic and political uncertainty is on the rise, and disruption from technology innovation is growing exponentially, exposing organizations to unfamiliar and sometimes unquantifiable risks. In parallel with these macro trends, more companies than ever see captive utilization as being at the core of innovative risk management strategies.

THE CAPTIVE LANDSCAPE – HIGHLIGHTS

1, Growth in captives globally

After more than 20 years of persistent growth, it is clear that the attractiveness of captives stems from an array of benefits,

not just one. As organizations’ understanding of risk matures, their risk management strategies become more sophisticated, increasing the likelihood of forming or expanding the use of a captive. Funding corporate

retained risk is a key value driver of captive formation for 62% of non-US and 74% of US Marsh-managed parents (see

Figure 2). A captive structure provides the flexibility to adjust risk retention strategies in response to market cycles or changes in exposures as a result of accelerated growth, mergers, or acquisitions. This puts the captive at the core of a risk manager’s toolbox to address traditional property/casualty risks as well as employee and customer risks.

2, The Spread Into New Geographies and Industries

Regulatory and tax considerations that fueled offshore captive formation decades ago have been either greatly

reduced or eliminated, creating a different environment for newcomers. Historically, most captives were formed

by parent companies from North America and Europe, but, over the past three years, we have seen increased interest

from emerging geographies. (“Parent companies” own the captive insurer, while a “domicile” is the country or state where

the captive is formed.)

3, Captive Structures Offer Flexibility

Captives come in many shapes and sizes and provide companies with tremendous flexibility in terms of how they structure

risk financing. While single-parent structures dominate (see Figure 11), special purpose vehicles (SPVs) are popular among banks and commercial insurers.

More information here:

Captives at the Core: The Foundation of a Risk Financing Strategy

Tags: Finance |