Two thirds of Czechs contemplate switching loans

9.03.2017Company: Amcham

UniCredit Bank introduces a revolutionary offer of PRESTO Loan – Consolidation of Loans. Subject to due repayment, clients can get a bonus of up to CZK 150,000, obtaining unrivalled interest rates starting from just 1.4% p.a. According to the current survey of UniCredit Bank, up to two thirds of borrowers contemplate switching lenders. When consolidating, the Czechs want to reduce both their monthly instalment and the total cost of repayment.

“We are going to offer historically lowest rates for consolidated consumer loans. Anyone contemplating switching loans can easily figure out that loans do not have to be expensive. When borrowers make due repayments and adhere to their repayment schedule, they are going to save a considerable amount of money,” says Ondřej Makovec, Consumer Loans Manager at UniCredit Bank.

Clients who consolidate loans over CZK 200,000 with UniCredit Bank get a CZK 50 thousand bonus after repayment of their loan. As for loans over CZK 600 thousand, clients can get a bonus of up to CZK 150 thousand. Practically, any client who switches loans as well as anyone refinancing bank overdraft or credit card and supplements the rest of his/her target volume by new funds for anything can get a bonus of up to CZK 150,000. Clients can easily obtain the favourable conditions at all branches of UniCredit Bank or UniCredit Bank Expres.

By switching loans, we mainly want to save money; the demand is increasing dramatically

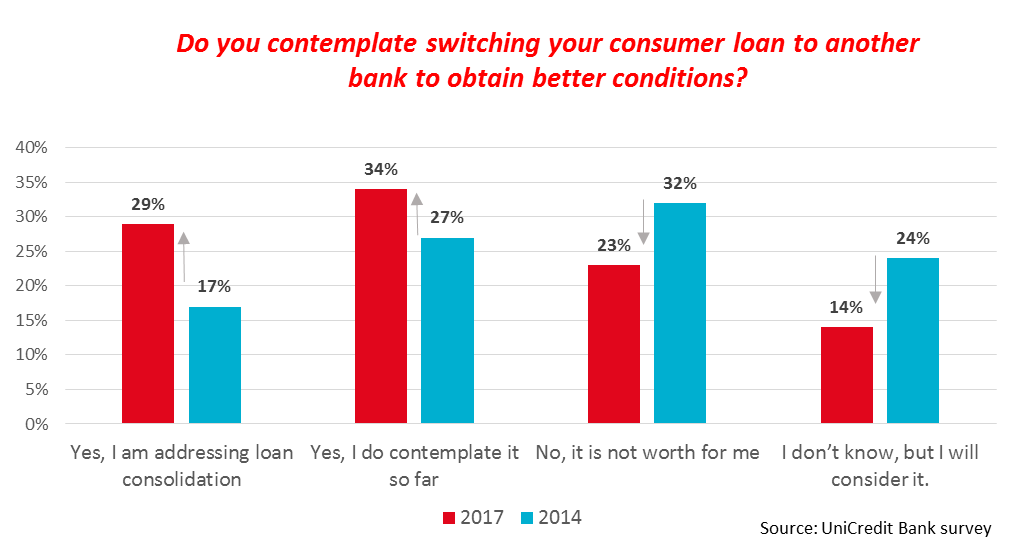

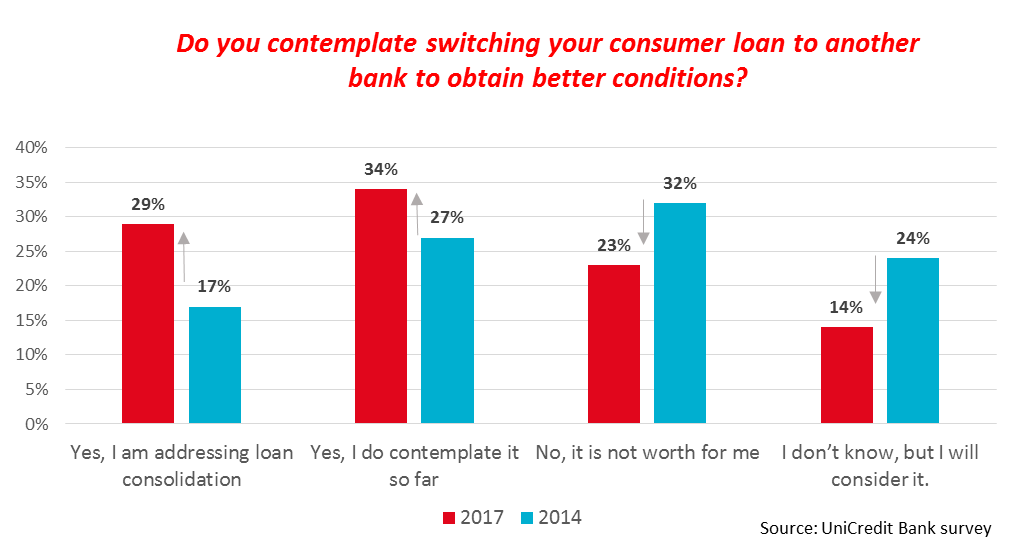

The Czechs are increasingly concerned about how to get better conditions for their consumer loans. 76% of the Czechs wants to save their cost. Therefore, the number of clients who are already actively addressing loan consolidation or switching (from 17 to 29%) as well those who are contemplating using this service (from 27 to 34%) has been sharply rising over the last three years. Overall, almost two thirds of borrowers are contemplating switching their loans (63%).

The UniCredit Bank survey was performed in February 2017 and November 2014 by DataCollect and Ipsos on a sample of 525 respondents aged 18 to 65 repaying consumer loans.

Tags: Finance | New Products & Services |